Every investor wants to see his stocks pay off – or he wouldn’t be in the markets. But finding the right investment, the ‘one’ that will bring in the high returns, can sometimes be challenging. A smart investor will apply a few basic, common-sense rules – and stick to them.

One of the basic rules of investing is “buy low, sell high.” This will naturally bring us to the low-cost, small-cap side of the stock market. While big names get the headlines, the small-cap stocks offer the highest returns.

With this in mind, we’ve used the TipRanks database to seek out three stocks that meet a profile; a market cap under $700 million and a share price below $10. Even better, these small-cap tickers have Strong Buy consensus ratings from the analyst community, and boast strong upside potential – starting at 80%.

Enthusiast Gaming Holdings (EGLX)

We’ll start with a company that’s hardly new to gamers, although it is new on the NASDAQ. Enthusiast Gaming, based in Toronto, Canada, is a major of digital media in the online video gaming world. The company owns and manages scores of brands in online gaming, including forays into journalism, social media, community chats, and actual game play. The numbers are considerable — the company’s esports brands boast over 100 million franchise fans, while Enthusiast Gaming’s ‘experiential’ segment, the annual live expo, saw more than 200 exhibitors, 30,000 attendees, and 5.6 million online viewers at last year’s event.

All of that generates a great deal of buzz, and Enthusiast Gaming rode that buzz right onto the NASDAQ index this past April. The move from the OTC exchange to the big board saw the EGLX ticker start trading on April 21.

The company has been growing rapidly, reflecting the popularity of online esports and video gaming. For the first quarter of 2021, EGLX reported C$30 million revenue (US$24.4 million), up 321% from the year-ago quarter. Gross profit came in at C$5.9 million (US$4.8 million), for an 80% yoy increase.

Drilling down, Enthusiast Gaming reported a total of 137,000 paid subscribers as of the end of 1Q21, which indicated 12-month growth of 49%. The company’s direct advertising sales increased from C$60,000 one year ago to C$2.2 million (US$1.79 million) in the current report. And in a metric that bodes well for the future, Enthusiast Gaming reported 9.9 billion total views of its written and video online content.

Furthermore, on June 24, the company closed its acquisition of the online gaming data tracking company Tabwire, owner of TabStats. The deal was worth US$11 million, paid in cash and stock, and brings two main Tabwire assets to Enthusiast: its proprietary technology, and its gamer database, totaling 13 million profiles.

Covering Enthusiast Gaming for H.C. Wainwright, 5-star analyst Scott Buck sees a clear path ahead for the company’s continued growth.

“The company’s owned and operated digital media platform includes more than 100 gaming related websites and more than 1,000 YouTube channels. This significant portfolio of digital properties is coupled with gaming and live event content creating a flywheel in which the company can monetize its digital assets. As monetization improves, revenue growth and gross margin expansion should serve as a meaningful catalyst in attracting new investors,” Buck opined.

The analyst added, “While the COVID-19 pandemic likely accelerated growth in gaming during 2020, we believe there is a foundation of secular growth which is likely to continue for several years.”

To this end, Buck rates EGLX a Buy and his $10 price target suggests an 80% one-year upside. (To watch Buck’s track record, click here)

Buck’s bullish stance on EGLX is hardly an outlier; in fact, Wall Street’s consensus is slightly more bullish. There are 3 recent Buy reviews on file, making the Strong Buy consensus rating unanimous. The shares are trading for $5.55, and the average price target of $10.45 indicates a potential upside of ~88% for the next 12 months. (See EGLX stock analysis on TipRanks)

Mogo Finance Technology (MOGO)

Switching gears, let’s look at a fintech stock. Mogo is a Canadian small-cap finance company, based in Vancouver, BC, that offers a range of services to its customers, including personal loans, prepaid Visa cards, credit score viewing, identity fraud protection, and even mortgage services. The company bypasses the traditional banking system, basing its services online and focusing on direct contact with its customers. That customer base is extensive; Mogo has over 1.6 million registered members.

This company is still feeling the effects of the economic dislocation that hit during the COVID crisis. First quarter revenues for 2021, at C$11.4 million (US$9.28 million), were down 17% year-over-year – although they did rise 14% sequentially. In a benchmark that is perhaps more important than total revenue, the company registered the second straight quarter of sequential growth in subscription and services revenue, which were up 32% from Q4, reaching C$6 million (US$4.88 million).

While still small, Mogo is growing, and reported two important news items in the last two months. During June, the company completed an acquisition of more shares in Coinsquare, Canada’s largest crypto platform. The recent move, which saw Mogo pick up another 2% Coinsquare, brings its total holding in the crypto platform to 37%. Mogo has retained its license to acquire up to 48% of Coinsquare.

Earlier, in May, Mogo announced that it had received ‘Visa Ready’ certification for Carta Worldwide, its wholly-owned payments platform. The certification allows Carta to expand its reach across North America and Europe, with access to Visa’s partner network.

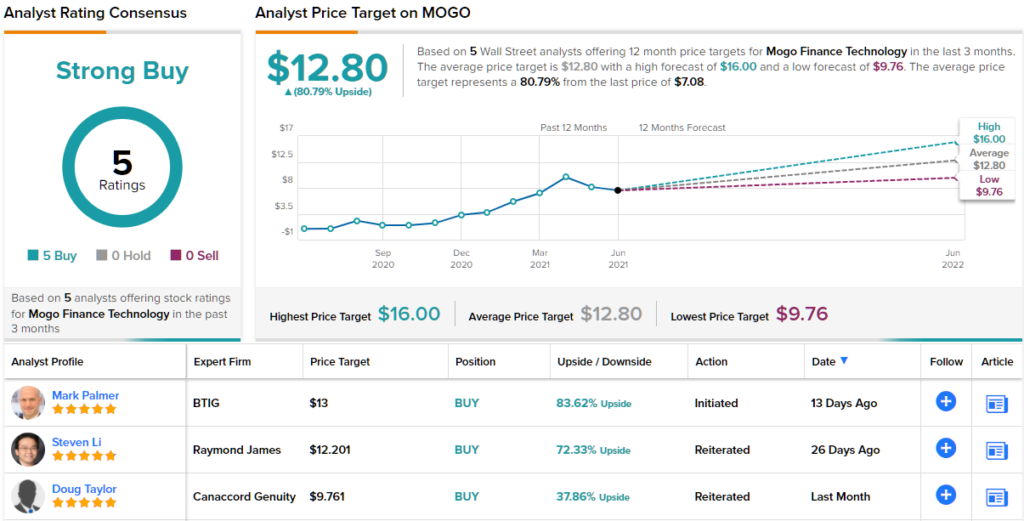

Among the fans is BTIG analyst Mark Palmer who rates MOGO shares a Buy along with a $13 price target. This figure indicates room for ~84% share appreciation from the current $7.08 share price. (To watch Palmer’s track record, click here)

“We believe MOGO offers an attractive means through which investors can play both the digital disruption of the Canadian financial services industry and the increasing adoption of bitcoin and other cryptocurrencies. The company’s current valuation does not reflect to any meaningful extent the value of its investment in Coinsquare even as that stake is worth at least $5 per share, in our view,” Palmer noted.

Overall, Mogo has plenty of Wall Street love; the stock’s Strong Buy consensus rating is supported by a unanimous 5 reviews. The average price target of $12.80 implies ~81% upside from current levels. (See MOGO stock analysis on TipRanks)

Avrobio, Inc. (AVRO)

Last but not least is Avrobio, a clinical-stage biopharmaceutical company, aiming to create one-dose gene therapy treatments for painful, debilitating, chronic disease conditions. Avrobio is working on treatments that will limit or stop the disease progression in lysosomal disorders, by inserting a therapeutic gene directly into the patient’s stem cells – and letting normal metabolic processes spread the gene through the body.

Avrobio’s pipeline has passed the pre-clinical stage, and entered into Phase 1 and 2 trials. The company has 5 gene therapy agents in development. The leading candidates are AVR-RD-01, a new treatment for Fabry disease, and AVR-RD-02, a gene therapy for Gaucher disease.

Regarding AVR-RD-01, after the completion of the Phase 1 trial, the company held discussions with the FDA on the regulatory path forward, and on the structure to be used for the registration trial. The Phase 1 included 5 patients dosed with AVR-RD-01, and early results demonstrated strong efficacy, acceptable safety, and good durability. Moving forward, the FAB-GT Phase 2 trial now has seven patients dosed, and enrollment continues in the US, Canada, and Australia. The company plans to enroll up to 14 patients in this trial.

AVR-RD-02, the investigational gene therapy for Gaucher disease, is currently in a Phase 1/2 study of safety and efficacy. The study focuses on patients with Gaucher type 1. Enrollment has begun in Canada and Australia, and the company intends to recruit 8 to 16 patients for this trial. Early data, reported during Q1, showed that plasma chitotriosidase levels decreased 49% and toxic metabolite lyso-Gb1 levels decreased 44% in the first patient at six months post-gene therapy.

Standing squarely in the bull camp is Needham analyst Gil Blum who rates AVRO a Buy along with a $28 price target. Investors could be pocketing gains of 183%, should Blum’s forecast hit the mark over the next 12 months. (To watch Blum’s track record, click here)

“AvroBio’s platform addresses key challenges with current and emerging treatments improving tissue distribution (i.e., CNS) while maintaining safety and long term activity. AvroBio has active clinical programs in 3 LSDs (Fabry, Gaucher type 1 and Cystinosis) with potential for >$2B in peak sales. We believe AvroBio’s encouraging early clinical results, the company’s early focus on commercial readiness using the Plato platform, and the promise of LV gene therapy in LSDs with CNS involvement set the company apart from its peers,” Blum wrote.

All in all, there are 7 recent reviews on file for this biotech firm, and they break down 6 to 1 in favor of Buy over Hold, giving Avrobio its Strong Buy consensus rating. The shares are currently trading for $9.89 and have an average price target of $22.20; this implies a robust upside potential of ~124% for the next 12 months. (See AVRO stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.